The two main questions we ask our clients at Domin Financial Services are:

The truth is... no one can predict the future, so let me help you eleminate any uncertainty in your retirement plan!

Meet Derek Domin

Founder & President

Derek is committed to helping peopleDerek has been in financial services helping families reach their financial goals for over 20 years. His personal one on one approach is focused on helping his clients reach their goals. Derek founded Domin Financial Services in 2011 with the commitment to help people navigate the sometimes-confusing road to retirement. He believes the dream to a happy, stress-free retirement starts by doing what you can today to successfully plan for the future. Derek is committed to helping people...

lifetime income through “Safe Money” principles made available through insurance products. He is licensed to present insurance products in Michigan and Florida. Derek calls West Michigan his home and received his Master’s in Finance from Davenport University. He enjoys spending time with his three children (Karissa, Danielle, and Jared) and his 6 grandchildren.

Meet Derek Domin

Founder & President

Derek is committed to helping peopleDerek has been in financial services helping families reach their financial goals for over 20 years. His personal one on one approach is focused on helping his clients reach their goals. Derek founded Domin Financial Services in 2011 with the commitment to help people navigate the sometimes-confusing road to retirement. He believes the dream to a happy, stress-free retirement starts by doing what you can today to successfully plan for the future. Derek is committed to helping people...

lifetime income through “Safe Money” principles made available through insurance products. He is licensed to present insurance products in Michigan and Florida. Derek calls West Michigan his home and received his Master’s in Finance from Davenport University. He enjoys spending time with his three children (Karissa, Danielle, and Jared) and his 6 grandchildren.

additional SERVICES

At least 70% of people over the age of 65 will need long-term care services and support at some point. With the cost of healthcare continuing to rise year after year, it is important to protect your assets from an unexpected event that can impact your family’s finances. We offer solutions for protection where benefits are paid directly to you or a medical provider that you designate. It's your choice. You have the Freedom to design a plan that fits your budget.

Who i've helped

T. Carpenter

I can now relax and enjoy my retirement knowing that my nest egg I build my entire life is SAFE. Derek is always there for me when I need him. Thank you, Domin Financial Services, for all of your help

T. Johnson

I worked for the Post Office for over 30 years. When it came to retirement advice, I had no idea where to start. I met Derek and liked his approach right away. He took the time to explain things to me in a way that I understand. I love the fact I do not have to worry anymore

D. Keys

Derek is incredible! He really cared about my concerns. Great guy! I sleep better at night knowing that my money is protected!

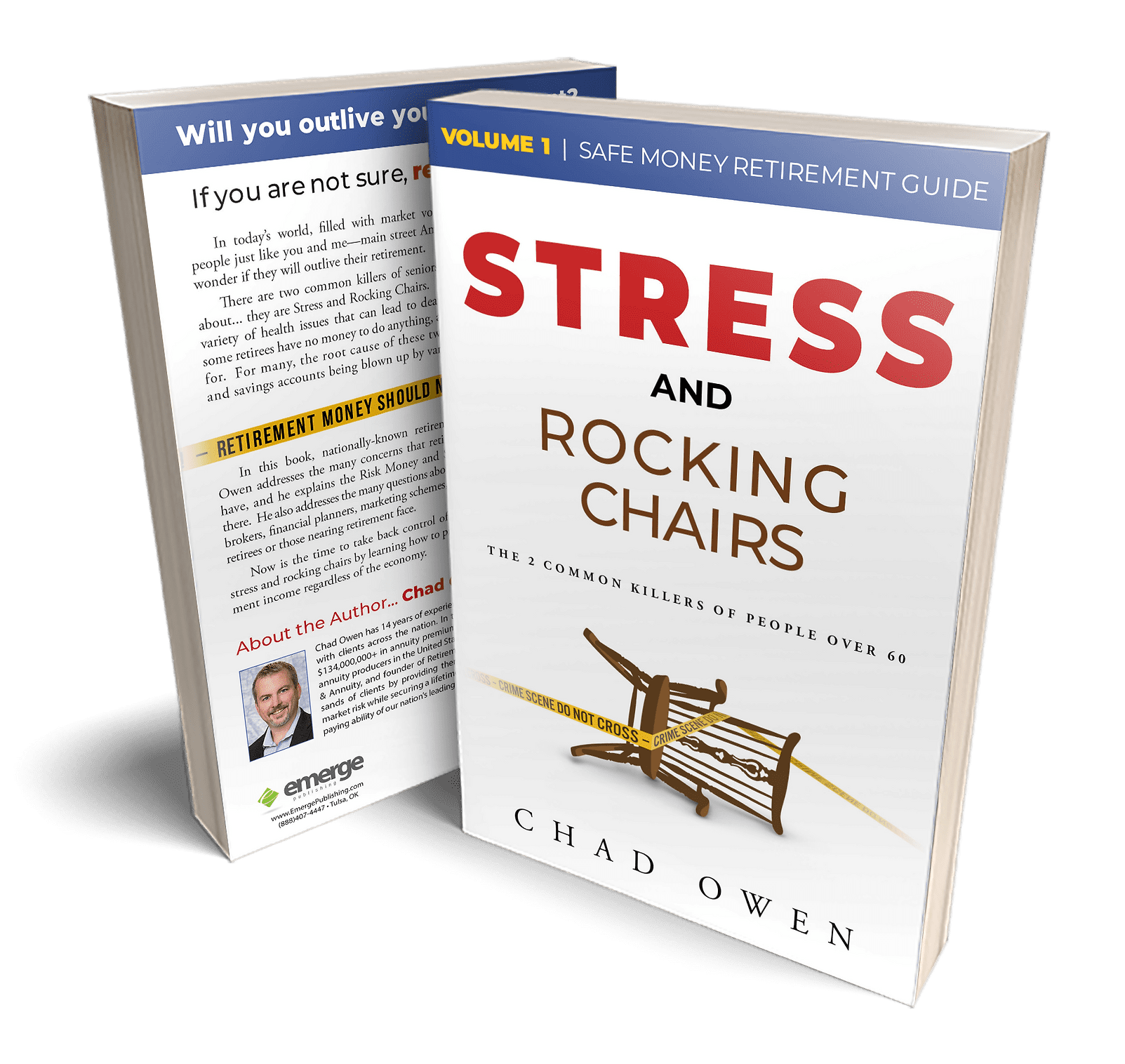

Get your complimentary copy of "Stress and Rocking Chairs" today!

Will You Outlive Your Retirement? If You are Not Sure... Then Stop What You are Doing and Read this Book! In today's world, filled with market volatility and economic concerns, people just like you and me, lie awake at night and wonder if they will outlive their retirement.

There are two common killers of seniors that few people realize or talk about... they are Stress and Rocking Chairs. Stress kills because it can cause a variety of health issues that can lead to death. Rocking Chairs kill because some retirees have no money to do anything, and consequently, nothing to live for. For many, the root cause of these two killers are retirement plans and savings accounts being blown up by variable and risk money!

Now is the time to take back control of your retirement, and say no to stress and rocking chairs by learning how to protect, save and grow your retirement income regardless of the economy.